Investiere in krypto roth ira

Inhalt

They offer end to end insurance on users' accounts and coins are stored offline in grade-5 guarded nuclear bunkers with round-the-clock protection, making it a top pick for security-focused investors.

Their customer service caters to those who are new to crypto trading, so even beginners can take advantage of the potential rewards of a crypto IRA. They offer traditional, Roth, SEP, and SIMPLE IRA accounts.

Are there any downsides? The starting contribution is quite high. Users are forced to open accounts through a digital currency specialist.

Their fees are unlisted, but cryptocurrency IRA accounts with Equity Trust Company as their custodian no longer have monthly fees regardless of balance. However, all accounts set up with Preferred Trust Company still have custodial fees.

5 Best Traditional And Roth Crypto IRA Accounts

Click Here to Learn More 4. Coin IRA: Best Customer Service A subsidiary of Goldco, which deals in precious metals, Coin IRA is a customer service-oriented crypto IRA founded in Investors make buy and sell orders via an account professional. Working with multiple exchanges to facilitate crypto trading, they've also partnered with a number of crypto wallets and custodians to ensure the safety of user coins.

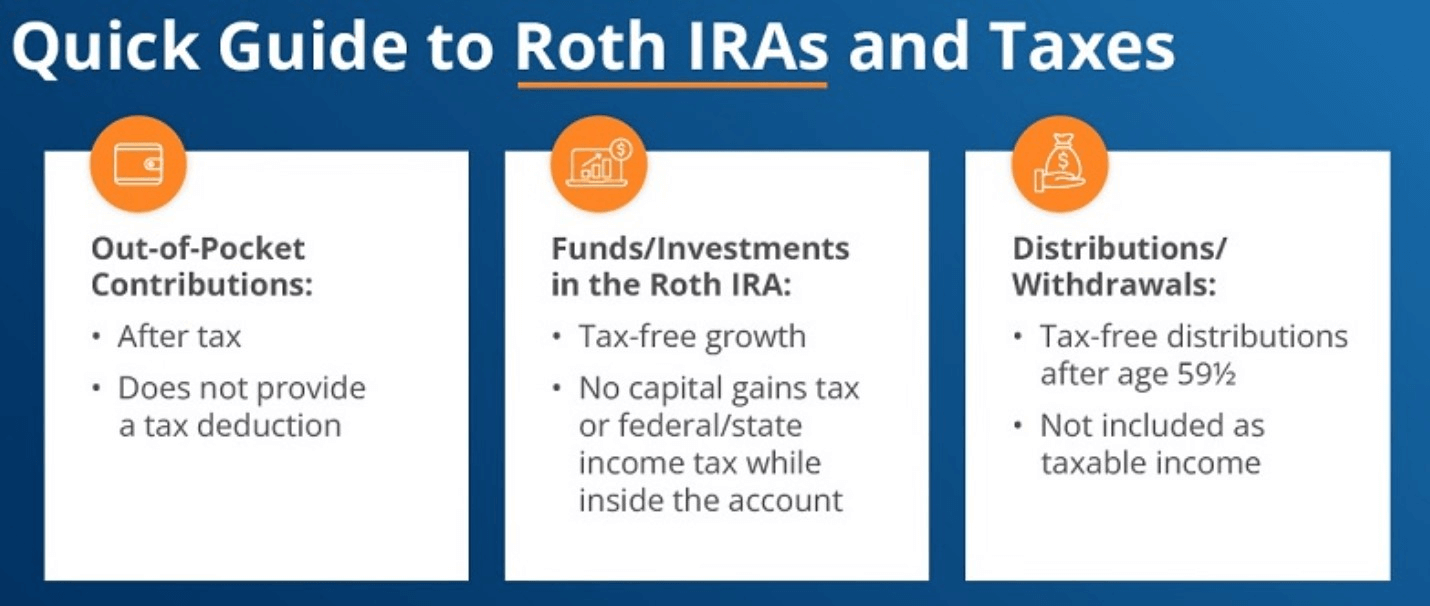

Where to Open a Crypto Roth IRA Would you like to avoid hefty capital gains taxes while building wealth with cryptocurrency investments? Investing in a crypto Roth IRA might be one of the easiest ways to do this. After that, all withdrawals made from your Roth IRA are completely tax-free.

Their website provides a range of educational information about the rules of owning a crypto IRA in their Ultimate Guide to Cryptocurrency Investing, as well as the latest crypto prices.

Their handholding approach ensures that customers should have no trouble opening and managing their accounts.

Bitcoin, Ethereum, Ethereum Classic, Chainlink, Dash, Litecoin, Stellar Lumens, Zcash Security Features: Hard Wallets Are there any downsides? There are no fees to set up, maintain, and store cryptocurrency inside your IRA but there are transaction fees.

The Best Roth IRA Investments (for long-term wealth)

They charge a self-trading transaction fee of 1. Broad Financial: Best for Experienced Investors Broad Financial offers crypto IRAs with checkbook control, a feature for experienced investors who want to take the most control over their investments.

- How to earn in bitcoin best 2023 bitcoin

- How to Buy Cryptocurrencies With a Roth IRA

Besides cryptocurrency, their IRAs support precious metals, real estate, and private stock. Supports independent crypto asset trading through the cryptocurrency exchanges of your choice.

Some of these accounts have eligibility requirements before they can be transferred to a Digital IRA.

Its flat-rate annual fees are ideal for high-value accounts. Has a wide selection of retirement savings account types available.

Rocket Dollar Cons: Charges high fees that are cost-prohibitive for investors with lower account balances. Specifically, self-directed IRAs enable users to invest in alternative assets like startups, real estate, farmland, art, investor-grade wine, and yes, even cryptocurrencies with all the tax advantages associated with an IRA.

Roth IRAs are a great choice for people who: Do not want to pay taxes on their investments Expect the market or particular asset classes to appreciate Believe income taxes will be higher when they take distributions Predict being in a higher tax bracket when they take distributions Do not want to have to take distributions at age 72 Roth IRA Rules, Income Limits, and Contribution Limits Congress originally created the Roth IRA as part of the Taxpayer Relief Act of to encourage more people to use IRAs to invest for the future.

Roth IRAs offered a potentially greater perk than traditional IRAs: Completely tax-free gains and distributions.

Congress imposed income limits on who could contribute to a Roth IRA as a way to prevent the ultra-wealthy from using a Roth IRA to shield income from taxes. Self-directed Roth IRAs fall under the same IRS guidelines as more conventional Roth IRAs.

Read this guide to learn more about what a self-directed IRA is and how you can use one to expand your portfolio to include digital currency like Bitcoin and crypto or alternative assets like precious metals. We provide a rundown of how a self-directed IRA differs from a traditional IRA, why only they allow crypto investments, and how to get started. We also outline the four essential things you need to consider before deciding which self-directed IRA is right for you and your crypto. Popular Crypto Apps Reviews On Want to start trading crypto?